Choosing Between a Global PEO or Legal Entity

A critical component of building a workforce for your global expansion is maintaining compliance with the HR regulations and requirements of your target countries. The two main ways for hiring in a foreign country are through a global PEO or directly through a legal entity of your own. We’ll walk you through what you need to know about both options so you can make the right choice for your business.

Hiring with a global PEO provider

A global PEO (professional employer organization), also known as an employer of record (EOR), allows companies to hire employees without a legal entity of their own. The global PEO hires the employees on your behalf and handles all the administrative compliance. They manage all the legal requirements and payroll without affecting the daily operations of the employees.

The nice thing about working with a global PEO provider, is you don’t have to worry as much about employment laws. Although there will always be risks when hiring employees overseas, PEOs help mitigate these risks. Because it is their legal entity, they are responsible for maintaining compliance and assume all the correlating responsibilities.

This is particularly advantageous with how frequently local laws and obligations change from country to country. Global PEOs eliminate the administrative burden associated with HR, payroll, legal and tax requirements. With all that out of the way, businesses can focus on the goals and growth of the employee.

Is a global PEO right for your business?

· You are doing some initial research and want to test the new market

· You don’t want to manage international contractors

· You want to hire fast in low volume countries

· You had a recent ‘surprise hire’ that needs to be onboarded

· You need a low-cost solution for a limited number of hires

This is often viewed as a cost-effective solution for short-term hiring or growth. The reduced risk and fast hiring makes this an attractive option for growing businesses.

Setting up your own foreign entity

International operations require companies to establish a legal presence in a country. This ensures businesses are compliant with employment regulations and tax requirements, among other things. Typically, there are dozens of steps involved in setting up your own legal entity, for example:

1. Appointing a representative

2. Checking and reserving a company name

3. Establishing an office

4. Registering the company with necessary government agencies

5. Publishing financial statements

6. Registering for federal taxes

7. Registering for benefit programs

8. Approving the office location

9. Acquiring necessary business permits or licenses

10. Registering for local state or provincial taxes

11. Opening bank accounts

It’s important to keep in mind that the more countries you operate in, the more complex the management process will become. You will be in charge of keeping up to date with the changing regulations of each country, and sometimes even within states or provinces.

Although this is often a good long-term solution for workforce growth, your international success depends on your understanding of these laws.

Related: DIY global expansion

You should also strategize on how to structure and implement employee compensation and benefits. Since you will be responsible for all employment operations, this is something you need to have in place while the entity is being established. Ensure when you establish a legal entity, it is set up correctly so you don’t have multiple countries competing for the tax revenue. This solution requires more time and effort in the beginning, but it is often more successful for large headcounts or stable, long-term growth.

Is setting up a foreign legal entity right for your business?

· The market is stable and you want to expand your operations in that region

· You have a large employee headcount

· You want to take advantage of your own tax strategy and benefits

· You’ve outgrown a PEO model and are ready to make the transition

· You have the time and resources to set up the entity

It might seem intimidating, but setting up your own local entity is a great solution for long-term growth. Once an entity is established, you have full control over your international operations.

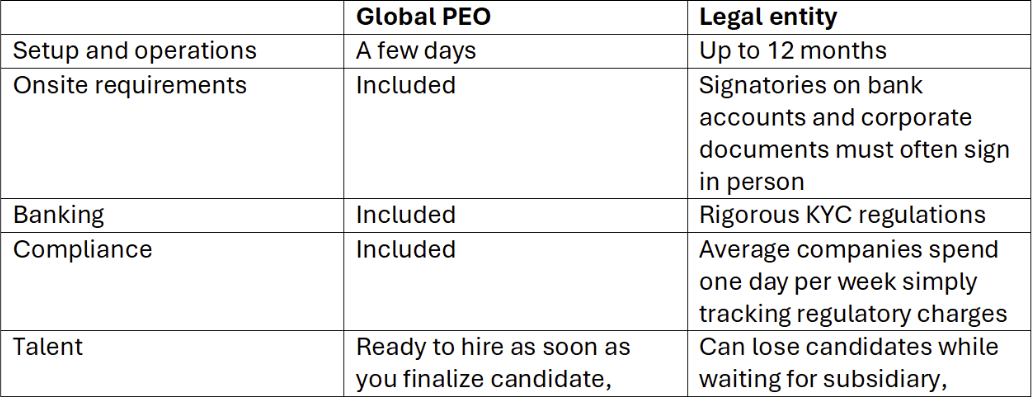

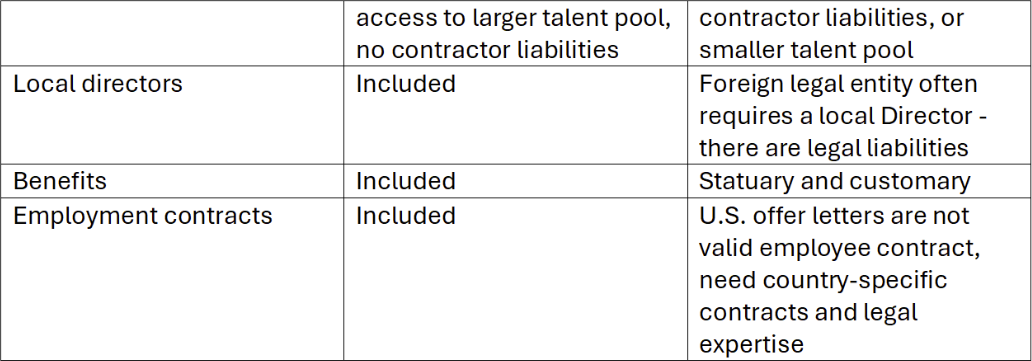

Comparing your options: Global PEO or legal entity

There are a lot of factors to consider when deciding between an international PEO or a legal entity. This quick checklist will help you determine what will work best for your growth needs.

Building a global workforce is a complicated but rewarding endeavor. Whenever you expand into new markets, there are bound to be unexpected challenges. Regardless of whether you choose a global PEO or legal entity, we can help you mitigate the risks associated with employment law, immigration, employee benefits and more.

About Global PEO Services

![]()

Global PEO Services, a Safeguard Global company, helps businesses expand internationally. Whether you leverage our PEO services, or decide to set up your own legal entity, we can help. We understand the challenges around global employment, HR services, compensation packages, benefit requirements, payroll, tax, and compliance issues.

Build your workforce any way you want. Hire employees fast, test new markets and implement long-term growth strategies with our team of experts. Reach out to an advisor today to learn how you can optimize your international expansion.