How India’s GST Will Impact Business

India’s controversial sales tax reform – Goods and Services Tax (GST) – has finally come into effect. On July 1, 2017 President Pranab Mukherjee and current Prime Minister Narendra Modi rolled out the GST in a special midnight session which both houses of parliament attended. This reform is expected to unify the $2 trillion economy under one tax umbrella.

The objective of incorporating the GST is to remove the current imperfections prevalent in indirect taxes and improve tax compliance; this will mitigate the effects of costly taxes cascading onto the end consumers. Its implementation is also expected to trigger growth in business and economy in India. While the GST is anticipated by many as to be the driving force in catapulting India’s economy through “one nation one tax,” it has encountered many roadblocks. One of the opposition largest concerns is the potential negative impact the GST will have on the lower- and middle-class populations.

This post aims to provide key insights into the GST, its impact on business, and what steps companies should take to adapt to this new bill.

The GST Explained

The GST is India’s new service tax, implemented to overcome many years of complex, diverse, and irregular tax practices across the 29 states and 7 union territories. A prominent tax service provider in India, ClearTax, defines the GST as a comprehensive, multi-stage, destination-based tax that will be levied on every value addition. These elements can be broken down into their separate components to simplify what this tax reform accomplishes.

Multi-Stage

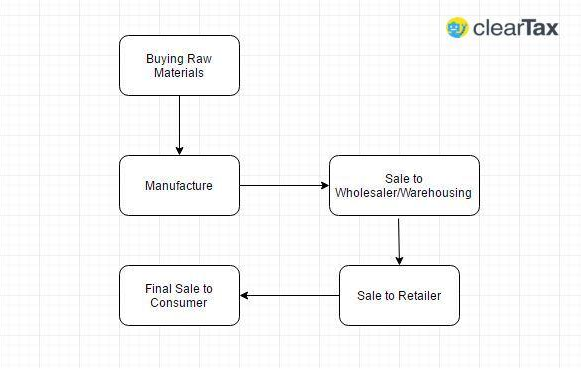

The “multi-stage”  element of the GST refers to the stages in the supply chain. This is the process of when raw materials are transformed into manufactured product, warehoused, moved to the retailer, and subsequently sold to customers.

element of the GST refers to the stages in the supply chain. This is the process of when raw materials are transformed into manufactured product, warehoused, moved to the retailer, and subsequently sold to customers.

Value Addition

“Value addition” refers to the increased value that a product gains at each stage of the product life cycle. For example, if a manufacturer intends to produce a pair of cotton pants, first they need to buy the raw material. When the raw material is processed into a pair of pants, it receives a higher value. When the pants are sent to the warehouse, a label is attached to it thereby increasing its value further. Subsequently, the value further increases when the pants are finally sent to the retailer and money is spent on marketing the pants.

Destination-Based

A “destination-based” tax moves away from the old tax practice in India where an excise duty would be levied on manufacturing and a subsequent VAT (Value-Added Tax) to be levied on the other stages of the product lifecycle. The reform imposes the GST at each point of sale. For example, let’s say a product is manufactured in State A, but the final sales takes place in State B. State A would receive the revenue for manufacturing and once the product is sold, State B receives the tax revenue for the sale.

One of the GST’s key impacts is its capacity to eliminate the effect of cascading taxes on consumers. The cascading tax is applied to a product at each stage of the product lifecycle. In turn, each seller in the supply chain will attempt to recover their losses due to the tax levied on them by the previous seller, building up at each successive stage until the final cost burden is shouldered upon the consumer. The GST resolves this by allowing the individual parties of the supply chain claim credit for the taxes they are paying, effectively lowering the end cost for consumers.

The GST is composed of three different goods and services taxes.

- CGST: Revenue is collected by the central government

- SGST: Revenue is collected by state governments concerning intra-state sales

- IGST: Revenue is collected by the central government concerning inter-state sales

A couple of notable items with special exemptions and/or delays under the GST are petroleum products and alcohol. Petroleum products – such as crude, diesel, motor spirit, and natural gas – are still not subject to taxation under the GST as government approval is pending. Alcohol is also currently not taxed under the GST.

Action Points

Here are the fundamental industry takeaways for the new GST.

- Equip your departments to understand the finer points of the GST and its overall framework

- Understand how the new tax rates and its processes will affect companies

- Begin restructuring the company to accommodate the associated changes from the tax

- Measure the impact of the tax on the financial aspect of your business

- Re-conceptualize pricing strategies in accordance to the tax

- Bring companywide departments in-line with the new IT requirements

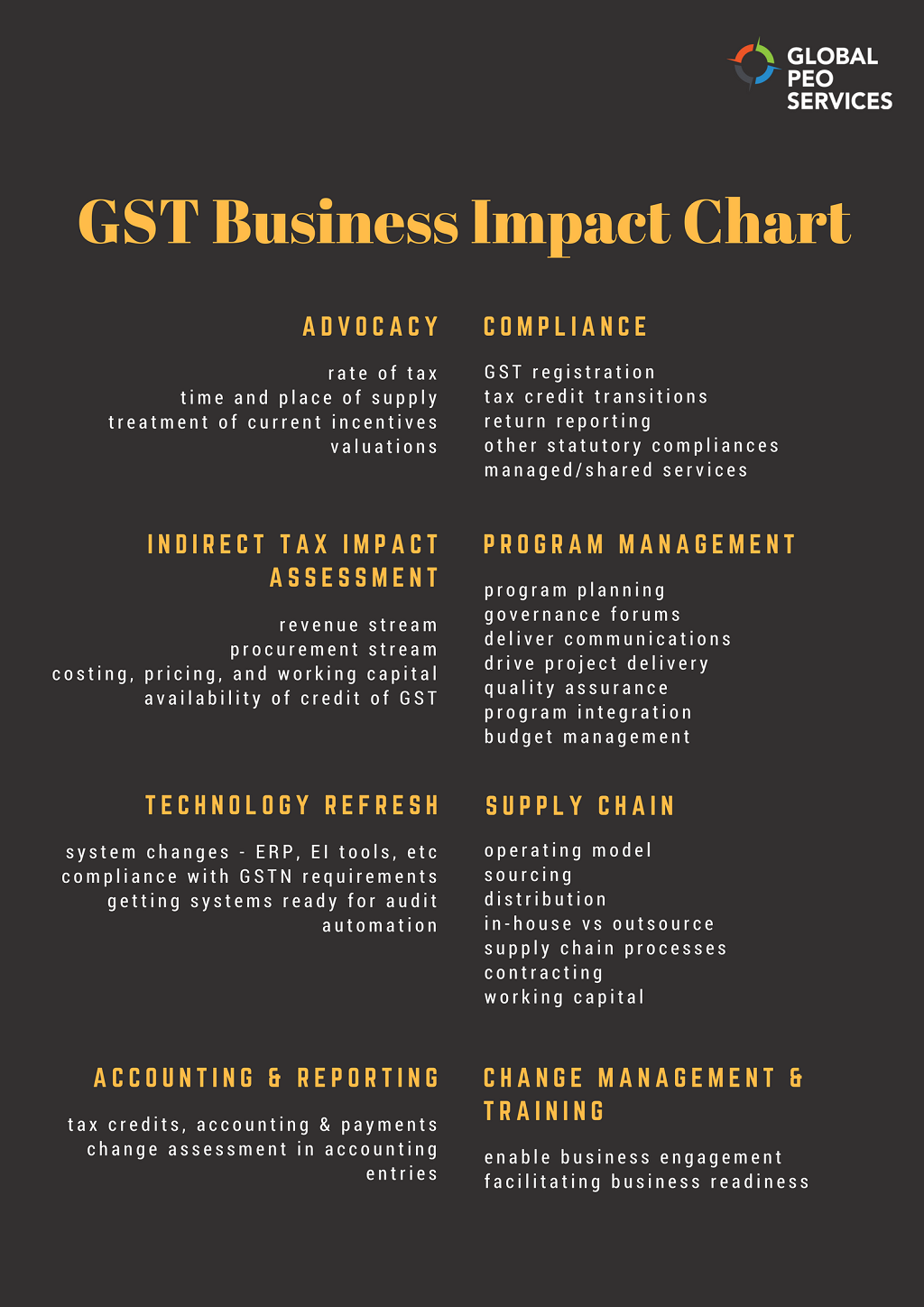

Overall, the impact of GST will be transformational as it will affect every aspect of business, including the supply chain, technology infrastructure, financial reporting, tax accounting, and more.

Learn more about our services, read more articles, or check out our sister company Global Upside.

About Global PEO Services

![]()

Global PEO Services (GPS) helps companies expand globally without having to set up legal entities in foreign jurisdictions and deal with related talent acquisition, HR, benefits, payroll, tax, and compliance issues. Hire employees fast, test new markets, or respond to growing business needs quickly while leaving the compliance and operational burden to us.

With our Professional Employer Organization (PEO) or Employer of Record (EOR) services, you get control without taking on legal entity liabilities, contractor risks, or sacrificing on talent and speed to market. Contact us today to learn more.

Partnering with an ideal PEO service provider can get you custom solutions aligned with your business objectives. If you are ready to take the next step toward hiring PEO services, we can assist you. Call us at +1-801-821-4905 or drop an email to info@globalpeoservices.com and one of our experts will contact you.